DPC networks have emerged as an important bridge between larger employers and independent Direct Primary Care (DPC) practices who want to grow their patient panel. Larger employer sponsors are more likely to commit to a DPC network than an individual DPC clinic in order to provide identical benefit offerings to all employees.

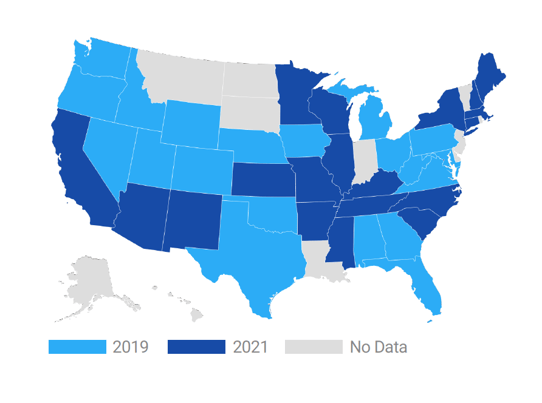

As outlined in Trends in Direct Primary Care 2022, DPC networks operating on HintOS grew from 20 states in 2019 to 40 states in 2021, doubling their geographic footprint and demonstrating notable growth. The data outlined in the report is based off of the networks that operate with Hint. HintOS currently supports 34 networks, one-third of which are provider-led networks that work with affiliate practices to manage large and geographically diverse employers. The other two-thirds are plan sponsors, such as third-party administrators (TPAs) and employers, who connect patients to providers without providing care directly.

States with a DPC Network in 2019 vs 2021.

Nine of the 34 DPC networks on HintOS have active membership at a Texas DPC practice, making it the state with the most DPC networks operating within its borders. Oklahoma, Florida, and Kansas tie for second with four networks each that contract with in-state providers. One in four practices on HintOS are affiliated with a network.

More than 50% of practices in Nebraska, Kansas, and Minnesota have at least one member from a DPC Network, making them the top states for network participation. Growth in DPC network participation has been highest in Texas, Florida, Idaho and Oklahoma, where the proportion of DPC practices participating in a network has more than doubled year-over-year since 2019.

DPC networks are a newer concept and just 2% of active DPC members on HintOS are affiliated with a network. On the provider side, DPC clinics who are unaffiliated stand to benefit tremendously by joining a DPC network. Examining data over the past five years, affiliated DPC practices saw “a 548% growth in the median number of active members per practice after three years in operation compared to 255% growth among non-affiliated DPC practices.” The DPC trends report breaks down the importance of DPC networks in propelling member growth.

We still have a long way to go in connecting the demand from large employer groups to the supply of Direct Primary Care providers if we want DPC to become a standard offering. However we have networks within our community that are great examples of what needs to be duplicated across the country. Some of these examples of DPC Networks include Nextera Healthcare and Primary Health Partners.

Nextera Healthcare is a DPC network that is based in Boulder, CO and was founded in 2009 by Clint Flanagan, MD and and his wife Deirdre Flanagan and as it grew in the community, they brought their offering to local small businesses and larger companies who were self-insured. In 2014, Nextera Healthcare started an affiliate network called Nextera Healthcare Community. To learn more about Nextera Healthcare and how they grew with HintOS, take a look at our case study. Primary Health Partners is another DPC network founded by Kyle Rickner, MD that runs on HintOS and is headquartered in Oklahoma with affiliates across several states.

There is also Hint Connect, Hint Health’s own curated network of DPCs, which aims to support the continued growth of DPC Networks and is currently operational in Texas, Oklahoma, Colorado, Arizona and Florida. Hint Connect brings together independent DPCs and DPC networks with mission-aligned plan sponsors who need broad coverage. DPCs may also leverage the Hint Connect network to serve larger employer deals without building their own affiliate network.

In a very short amount of time, DPC networks have grown rapidly to support employer needs. Based on these trends they will play a key role in accelerating the adoption of DPC and making it the standard of care.