Self-funded health plans have been steadily increasing in popularity. Currently, 39% of all employers in the private sector offer health plans that include at least one self-insured option. This is a huge jump from 1996, when 28.5% of employers self-insured.

Large employers with thousands to hundreds of thousands of employees are more likely to self-insure because they have the resources to pay most claims directly. Additionally, they can spread the risk of uncommon costly claims across a considerable number of employees (and their dependents, if covered). A 2018 survey by the Kaiser Family Foundation reported that 91% of covered workers in very large companies – with 5000 or more employees – are in self-funded plans.

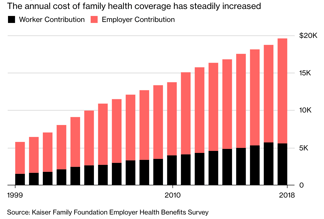

Regardless of the fact that, historically, self-funded healthcare was only undertaken by large employers, the rising cost of healthcare is changing this. More small and mid-sized employers are switching from fully insured plans to self-insured plans because it reduces their costs and results in better healthcare outcomes for their employees.

According to The Kaiser Family Foundation survey, as of 2018, 50% of covered workers in mid-sized companies (with 200-999 employees) are in self funded plans, while the figure is 13% for small companies (3- 199 employees).

This is producing a ripple effect and accelerating the rate at which employers adopt self-funded healthcare. Other employers, who would ordinarily be wary of self-insuring, are seeing their peers’ success with it and are switching.

At the core of it, employers are looking for the same things direct care providers are: lower costs, better care and fewer restrictions. And self insurance is how they accomplish that.

Lower Costs

When dealing with insurance companies, like in fully funded insurance models, employers are directly and indirectly paying for the insurance company’s profit margins and administrative costs, retention charges, and state premium taxes. Offering self-insured plans helps employers save and reduce their healthcare expenditure by cutting those costs out.

Self-insuring also lets employers flexibly design their plans in ways that can eliminate avoidable expenses. This motivation – reducing employer spend – is missing when insurance companies make health coverage plans.

Self-insuring also lets employers flexibly design their plans in ways that can eliminate avoidable expenses. This motivation – reducing employer spend – is missing when insurance companies make health coverage plans.

Being self-insured doesn’t mean employers have to leave themselves open to uncapped risks. To protect themselves against unexpectedly high claims, some employers purchase stop-loss insurance to mitigate their risk when employee claims exceed certain amounts.

And in situations when the fund earmarked for employee healthcare is not completely used up, the surplus can be reinvested into the company at the employer’s discretion.

Employers who want to self-insure can do so individually or by teaming up with other employers in similar industries. The different employers pool their resources and agree to jointly cover healthcare claims of the employees of all the members in the group. This arrangement is particularly advantageous for smaller employers who may not have the liquid resources to fund their healthcare costs individually, but want to enjoy the benefits of self-insurance.

There’s also the benefit of improved cash flow. Being self-insured means an employer doesn’t have to pay for any healthcare until the provider’s services are needed. This is unlike traditional insurance models, where employers have to pre-pay monthly premiums to cover potential claims by employees.

As a result, self-insured employers can exert more control over their cash flow than when they’re paying premiums to insurance companies. They can channel more of their resources to the company’s development and growth.

Related Videos

Better Healthcare Outcomes

Employers that self-insure are better equipped to improve healthcare outcomes for their workforce. For one, employers get to choose the providers, provider networks, pharmacies, and vendors that will best serve their employees’ needs.

Secondly, the health plans can be designed and customized to meet specific employee needs, as opposed to having to go with the ‘one size fits all plans’ some insurance companies offer. This is beneficial for companies where the employees face peculiar workplace hazards or common health risks at heightened levels.

Finally, self-insured employers have access to data about healthcare claims, which is crucial to the continuous adjustments and enhancements a health plan needs to maintain a healthy employee-base.

Fewer Restrictions

Employers self-insure to retain control over the benefits they will cover in their health plans. They don’t need to negotiate with insurance companies to make changes or add-ons to the plans; in fact, in practice, only large employers can even wield such negotiating power in the first place. Employers can decide to cover services like telemedicine, digital health solutions, and corporate wellness programs, whenever and however they want to.

The bonus of reduced regulations also exists. Self-funded health plans are not subject to state insurance laws. Instead, they are regulated under the Employee Retirement Income Security Act of 1974. So, self-insured employers are not obligated to comply with state regulations that mandate minimum coverage for certain benefits.

Finally, whether administering self-insured plans through a TPA (Third party administrator) or in-house, there is complete data transparency. TPA’s typically provide employers with monthly reports delineating healthcare claims, pharmacy costs, and how funds are spent. The employer can also decide what degree of detailing the reports should contain. If the administration is going on in-house, the employer already has direct access to all the data.

An Opportunity for Direct Primary Care

Employers are discovering that direct primary care providers offer the type of innovative, cost-effective care needed for self funded plans to-succeed. Hint Health is partnering with Health Rosetta to connect the DPC community directly with employers whose goals align. Sign up here to get involved.