We are launching a set of major improvements to our employer invoicing flow, as part of an ongoing initiative to improve our Employer solution.

These changes will make the invoicing flow more customizable in terms of when employer invoices are issued, when they are shared with the employer, when they are due, and when they become past due. In addition, we are introducing the concept of draft employer invoices, which will make it easier for you and your employers to review invoices and make changes to them before the invoice is issued and paid.

How does it work?

Previously, employer invoices in Hint were generated on the 2nd of each month. Once generated, invoices were automatically visible to employers on their Hint Employer Portal, and emailed to employers if you have that email notification turned on. The due date for employer invoices was the 8th of the month, and they became past-due that same day.

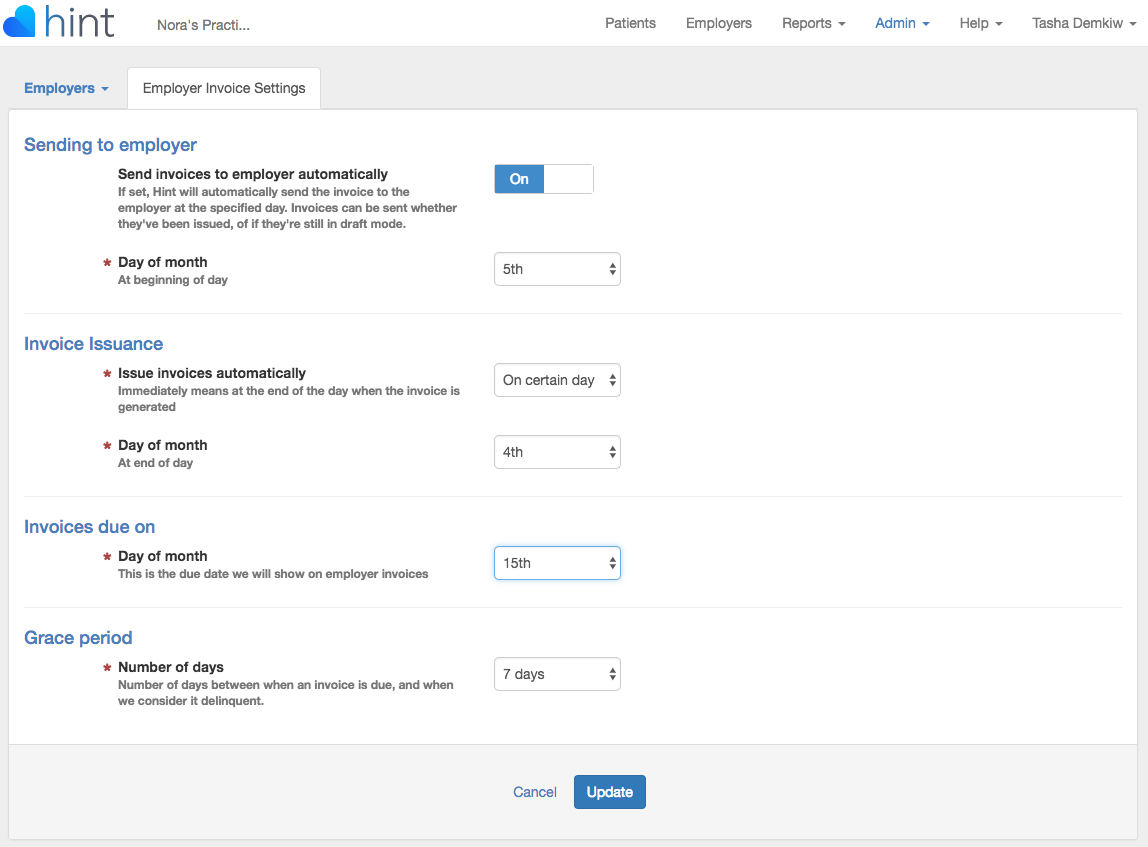

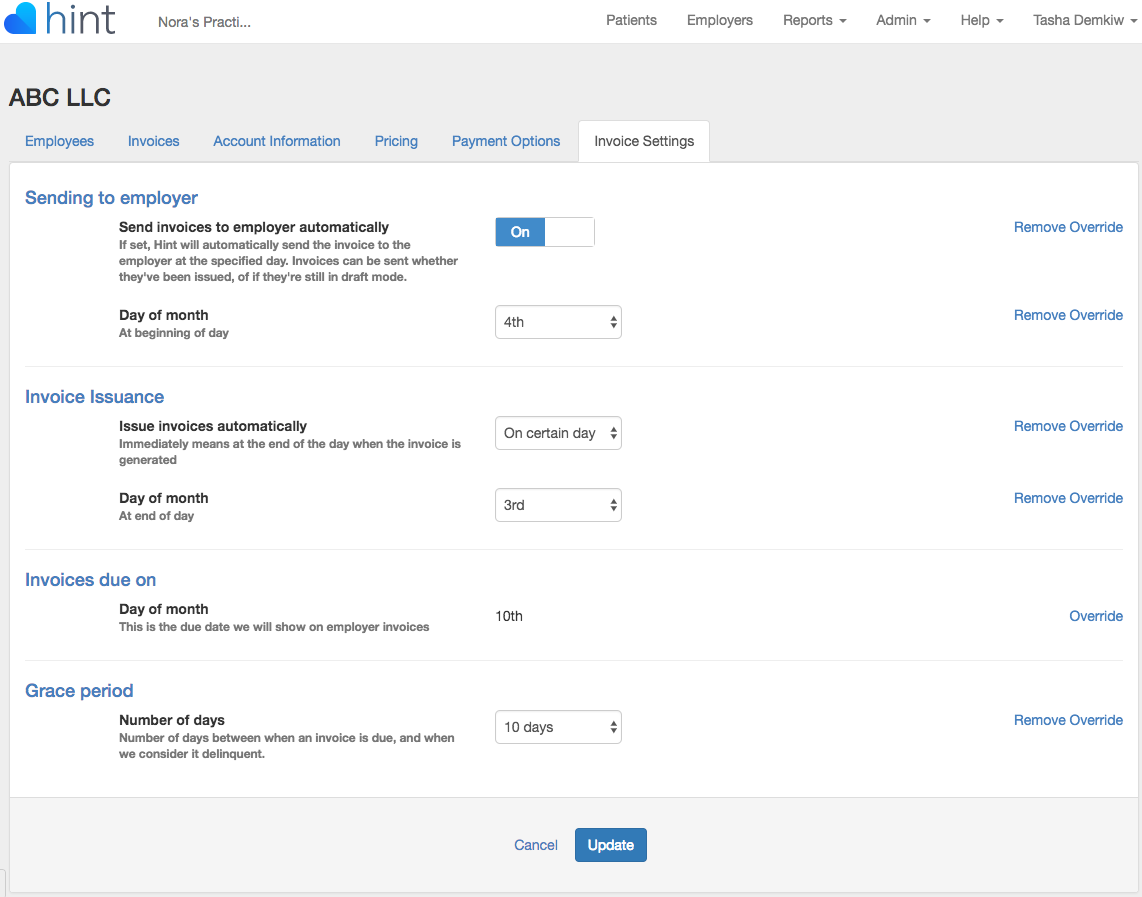

Now, all of the above parameters have been made configurable for your practice as a whole, as well as for each individual employer separately. In the Admin drop-down, you will now see a new page labeled "Employers", where you can customize whether and when invoices are shared with your employers automatically, whether and when invoices are issued automatically, when should invoices become due, and how much of a grace period employers should have before their invoice is considered past due.

Draft invoices

Probably the most exciting part of this product release is the change we're making to how invoices are generated and updated. Previously, once employer invoices were generated they were pretty much set in stone. If you needed to make any changes to your employer invoices, you had to contact Hint support.

Starting today, employer invoices are generated in advance into "draft mode", so that you and your employers can review invoices ahead of when they're due, and make changes to them if necessary.

How do draft employer invoices work?

As long as an employer invoice is in "draft", it is automatically updated in real-time as enrollment changes happen. For example, let's say that ACME's March invoice is in "draft". Regardless of what date it is today, if an ACME employee is enrolled in a membership starting on or before March, Hint will automatically add that employee to ACME's draft invoice. Similarly, if an employee is unenrolled for the March time-frame, Hint will automatically remove that employee from the March invoice.

When are invoices generated?

Invoices are generated into "draft mode" in the following two situations:

- When an invoice is paid

- When an invoice becomes past-due

This means that you should always have next month's invoice available to preview well in advance.

What does it mean to "issue" an employer invoice?

When an employer invoice is issued, Hint will stop making changes to it. For example, let's say that ACME's March invoice has been issued, and now a new employee is enrolled for a 3/1 membership start date. Since the March invoice has been issued and is no longer in "draft mode", Hint will not add the new employee to the March invoice, so that employee will probably be charged twice on the April invoice.

Can I share draft invoices with my employers?

Absolutely! We actually recommend sending invoices to your employers when they're still in draft mode. That way, your employers can review the invoice and make enrollment changes if necessary before the invoice is finalized and paid.

Keep in mind that invoices have to be issued before they can be paid. However, if you share a draft invoice with an employer, the employer can "approve" the invoice, which issues the invoice and makes it payable.

By default, invoices are shared with employers on the 2nd of the month, and are automatically invoiced on the 8th of the month.

Will Hint notify my employers of this change?

Yes, we are planning to send an email to employer admins notifying them of these changes on Tuesday 12/19. If you prefer for us to not update your employers about these changes, please let us know at support@hint.com.